One of the most potentially gamechanging announcements of the past month was OpenAI and Stripe’s collaboration to add Instant Checkout to ChatGPT:

There have been many attempts at monetizing agents (x402) and working out agent to agent protocols, including over MCP, but the entry of two category leaders in AI and payments is obviously impactful and needs to be watched closely.

Emily Glassberg Sands, Stripe’s Head of Data & AI, joined us today to talk about Stripe’s new mission to build the economic infrastructure for AI, and how they both use AI internally and see it as an advantage for the next phase of economic growth.

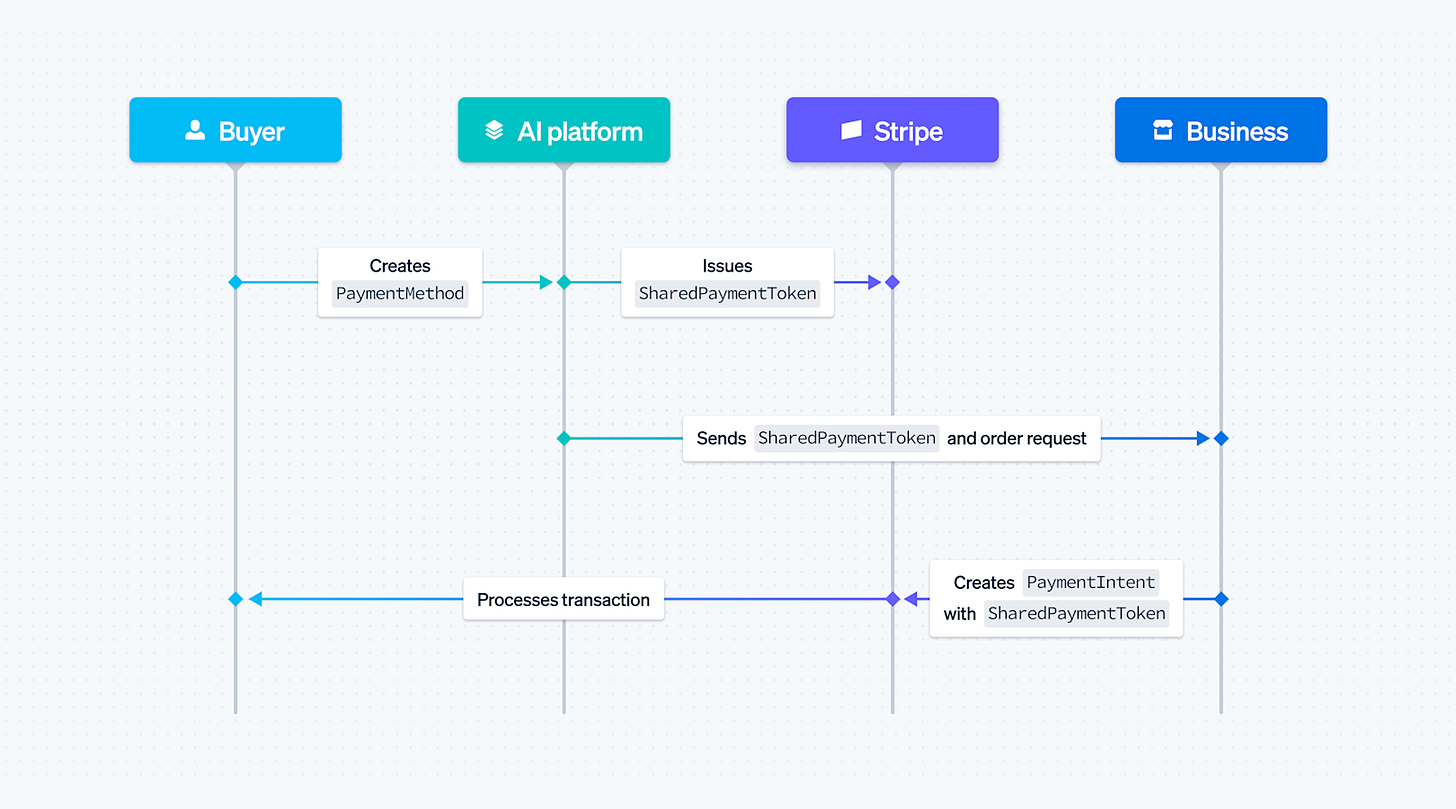

Inside ACP: the low level spec for agent payment

ACP is Stripe’s protocol jointly developed with OpenAI, which powers ChatGPT Commerce; it lets agents discover and purchase from merchant catalogs across ecosystems. The core components:

- Catalog schema. Products, inventory, pricing, brand constraints, etc.

- Shared payment token (more below)

- Risk signal. “Good bot/bad bot” scores ride with the token so merchants can decision intelligently.

The ACP is being coupled with Stripe’s Link product, which has 200m+ consumers, as the wallet for your credentials. (Fun fact: 58% of Lovable revenue comes from Link transactions)

SharedPaymentToken (SPT) design:

- Scoped to specific business, time-limited, amount-capped, revocable. Buyers use existing saved payment methods without re-entry

- Underlying credentials are never exposed to agent and it’s designed for compatibility with card network agentic tokens like Mastercard’s

- When processed via Stripe, includes Radar risk signals (fraud likelihood, card testing indicators, stolen card signals, etc)

Building a foundation model for payments

Emily has talked about this elsewhere, but it needed to be covered.

ML for fraud detection was one of the “old” AI markets, but it was not super reliable. Stripe only had 59% accuracy on card testing transactions for example. Move from task‑specific models to a transformer-based domain foundation model that produces dense payments embeddings to power many downstream tasks:

- Treat each charge as a token and behavior sequences as the context window.

- Ingest tens of billions of transactions (50,000/min) with full feature breadth: IPs, BINs, amounts, methods, geography, device, merchant traits, and more.

- Focus on “last‑K” relevant events across heterogeneous actors and surfaces (login, checkout attempts, retries, issuer responses).

It lifted large‑merchant card‑testing detection from 59% to 97% and also helps merchant with transaction clustering, checkout optimization to understand user flows, etc. Every single Stripe transaction goes through this model in <100ms.

AI has added new types of fraud too as the cost of inference is now meaningful. A free trial abuse with a virtual credit card in the past would be annoying, but the cost of serving that user was low. Fraudsters are now burning tens of thousands of dollars of AI tokens using virtual credit cards or through chargebacks, which makes this much more important to get right.

Token Billing vs Outcome pricing

Everyone is a big fan of the pareto frontier charting for model capabilities, but it’s extremely hard as a product builder to offer the user choice while having a static plan. At the same time, users don’t want to use dumber models just to fit your pricing and they’ll often want to pay more for more intelligence. Stripe built Token Billing which calculates billing based on the model:

effective_price_per_unit = base_margin + (model_tokens_used * provider_unit_cost) + overhead

The other approach that companies are taking is outcome based pricing, which we also covered in our Dharmesh Shah episode. Intercom charging $1 per solved customer support ticket is an example.

Stripe’s internal AI stack

-

Toolshed (MCP server). Central tool layer wired into Slack, Drive, Git, data catalog (Hubble), query engines, and more. Agents can both retrieve and act using tools.

-

Text‑to‑SQL assistants.

- External: Sigma Assistant works well because revenue data is canonical.

- Internal: “Hubert” (used by ~900 people/week) sits on Hubble for broad data; biggest failure mode is data discovery. Most of their work has been on deprecating low‑quality tables, creating human‑owned docs for canonical datasets, and persona context (“which org you’re in”) to give as system prompts to bias table selection.

-

Semantic events + real‑time canonicals. Re‑architecting payments and usage billing pipelines so the same near‑real‑time feed powers Dashboard, Sigma, and data exports (e.g., BigQuery) with one source of truth that LLMs can consume.

-

Engineer adoption. ~8.5k Stripes/day use LLM tools; 65–70% use AI coding assistants. “Impact” measured beyond LOC/PR counts and more empirically on developer perceived productivity.

-

LLM‑built integrations. A pan‑EU local payment method integration went from ~2 months → ~2 weeks, trending to days.

The AI economy Stripe sees in the data

We figured we’d get some #s to fuel the “AI startup bubble” discourse on X :)

- Go‑to‑market velocity. Top 100 AI companies on Stripe hit $1M/$10M/$30M ARR 2–3× faster than a comparable SaaS cohort five years prior.

- Global from day one. ~2× the country count by year end; median AI company operates in 55 countries in year one, >100 in year two.

- Retention dynamics. Per‑company retention slightly lower than SaaS, but churn is often switching, not abandoning the problem; customers boomerang as products leapfrog.

- Tiny teams, big revenue. Revenue per employee outpaces elite public benchmarks. Unit economics depend on inference costs trending down; plan for volatility rather than current spot prices.

- 7x growth rate. Companies on Stripe grew 7x faster than S&P 500 last year.

Full Video Pod

On YouTube now!

Timestamps

- 00:00:00 — Introduction and Emily’s Role at Stripe

- 00:09:55 — AI Business Models and Fraud Challenges

- 00:13:49 — Extending Radar for AI Economy

- 00:16:42 — Payment Innovation: Token Billing and Stablecoins

- 00:23:09 — Agentic Commerce Protocol Launch

- 00:29:40 — Good Bots vs Bad Bots in AI

- 00:40:31 — Designing the Agents Commerce Protocol

- 00:49:32 — Internal AI Adoption at Stripe

- 01:04:53 — Data Discovery and Text-to-SQL Challenges

- 01:21:00 — AI Economy Analysis: Bubble or Boom?

Show Notes

Transcript

Alessio [00:00:00]: Hey everyone, welcome to the Latent Space podcast. This is Alessio, founder of Kernel Labs, and I’m joined by Swyx, editor of Latent Space.

Introduction and Emily Sands’ Role at Stripe

Swyx [00:00:03]: Hello, hello. We’re back in the studio with Emily Sands from Stripe. Welcome.

Emily [00:00:13]: Thank you.

Emily’s role as head of data and AI at Stripe and company overview

Swyx [00:00:14]: So Emily, you’re head of data and AI at Stripe. That’s a big title. What does that actually mean in practice?

Emily [00:00:21]: So Stripe is building financial infrastructure for the internet. We started out as payments infrastructure, and now we are helping businesses solve a whole range of problems. How do they accept recurring payments like subscriptions? How do they do usage billing, revenue recognition, tax, money movements, accept stable coins, and more? And when you think about what we’re looking at, we’re looking at on the order of 1.3% of global GDP. About $1.4 trillion a year is processed on Stripe. And so that obviously creates a very unique opportunity to use that data to understand both what’s happening in the economy. What do our users need? But also feed it back into the product to power better payments experiences, so cut down on fraud, drive the right authorization, better customer-facing experiences, optimizing the checkout suite, and more. So anyway, our data and AI org is just really focused on helping Stripe make effective use of our data. And that starts sort of all the way at the foundation layers, right? Like, what’s the data platform? How do we do data engineering? What are our ML infrastructure, AI infrastructure? And then all the way up to the technology. And then all the way up to the applied layer. We also have a fun little group. It’s actually quite small. It’s just two dozen people, but we call it the Experimental Projects Team. And it’s not data-specific, but the premise is experimentation can and should and does happen everywhere. But there are often these sort of cross-Stripe opportunities that are being pulled out of us by our users, just given the pace at which the world is changing, that aren’t natural or easy to jump on within any one product vertical. And so these are just quite senior, quite seasoned engineers who run at those opportunities and zero to one them and get them off the ground. So our agentic commerce work came out of that. Token billing, which we can talk about in a bit, also came out of that. And that’s just a fun sort of side angle within our group that’s proven very high leverage.

Swyx [00:02:18]: Yeah, I like the framing that Stripe’s mission is build financial infrastructure for the Internet. And your subset of that is build economic infrastructure for AI. Yeah. And that’s a pretty...

Stripe’s AI Journey and Investment in Foundation Models

Alessio [00:02:30]: Ambitious goal. You’ve been at Stripe four years. At what point did AI become a title-level thing? Because, I mean, you were obviously using machine learning for fraud detection and everything. You were at Coursera. Yeah. Yeah.

When AI became a title-level focus at Stripe and early ML/AI applications

Emily [00:02:43]: We started investing in AI or LLM-specific experiences basically when GPT-3.5 hit the scene. We were like, okay, we need everybody to be able to have high-quality, safe, easy... ...access to LLMs, not just for their own, you know, day-to-day work usage, but actually to build, you know, production-grade experiences. So that’s sort of, what was that, early, like, January 2023 or late 2022. We started reasoning about, okay, like, you know, it’s not just ML infrastructure. It’s also AI infrastructure. It’s not just ML applications. It’s also AI applications. But then it was really only in the last year and a half or so that we said, hey... I mean, we had, like, transformers and whatever before. But only in the last year and a half or so that we were like, hey, we actually need to have our own domain-specific foundation model. And actually, we can move from these, you know, single-task, point-solution ML models to, you know, a much richer, denser payments embeddings that can then power the various downstream applications. So I think it was an evolution for us. And, you know, I think we could still debate, like, what’s ML and what’s AI in the industry at large. But you’re right. We’re more than a decade into using ML at Stripe, you know, way back in the early days for not just radar, which I think people know about, right? Like, the machine learning systems that block fraud for our customers, but also ML internally for our own operations. Like, every other payment service provider is onboarding max a dozen users a day. We’re onboarding thousands of users a day. And you have to make sure they are supportable and not fraudulent. And are creditworthy because you are processing their transactions. And that alone requires machine learning and long has. Yeah.

Detecting Card Testing Fraud with Foundation Models

Swyx [00:04:37]: I would say, you know, it’s kind of interesting how the domain-specific models first come up, like, pre-foundation models. And then we have this foundation model era. But then at the scale of Stripe, I imagine that you also have to just serve in so much volume of inference that then you might have to domain-specialize them again. Yeah, so there’s fine-tunes on top.

Foundation models and card testing fraud detection

Emily [00:04:59]: There’s fine-tunes on top. I mean, we see, like, 50,000 transactions a minute.

Swyx [00:05:05]: But not all of that goes through your foundation model.

Emily [00:05:08]: Yes, every single transaction. So, for example, the foundation model, one of the things it powers is detecting card-testing attacks. Do you guys know what card-testing is? Yeah. Yeah, okay. So, for listeners, it could be, like, a card tester could be enumerating through cards or they could be random-guessing cards. They find a card that works and then sometimes they use it for fraud. More often, they sell it. Lots of traditional machines. Machine learning models can do a pretty good job detecting card-testing. But card-testers have gotten clever. And one of the things they do is that they hide their card-testing in the volumes of very large businesses. So, if you think about a very large e-commerce company, you can think about how many transactions are there. A card-tester might sprinkle, like, 100, 200, 3, 4, 5-cent transactions in testing. Traditional ML is, like, not going to catch that. Then you have a foundation model. Each, you know, charge becomes this, like, dense embedding. You start to see these clusters sort of pop out and you know in real time that they’re card-testing and you can block them. So, yes, it is happening on the charge path in less than 100 milliseconds of latency.

Alessio [00:06:15]: Have the foundation model enabled more data to be put in the embedding? I think, like, you know, things like, you know, number patterns and, like, zip code versus, like, location. I think those you could do before. Are there any new data points that you get? Yeah.

Embedding Payments Data and Behavioral Sequences in AI Models

Emily [00:06:28]: So, I think there’s... I think there’s two big things. Like, one, you know, when you’re building a small model, you’re usually, like, oh, looking at the data that, like, has reasonable labels. It’s, like, recent history. You probably have some, like, hand-engineered features in many cases. If you’re actually, like, building an FM and you’re imagining there’s many downstream use cases, you’re putting, you know, tens of billions of transactions in it. You’re putting, like, the entirety, like, every detail of the payment in it and letting the FM run. And you’re putting some reason about what are the components that matter versus not. So, it is literally all the things. But I think what’s even more interesting is, like, the last K. Like, what matters is the sequence. You can think of a payment sort of like a word. And so, you can think of payments data kind of like language data. And what matters isn’t the word, right? It is the word in relation to the words around it. But what’s tricky about payments is you don’t see, like, you know, Emily on a podcast saying 20 words. And no, those are not 20 words. Like, the sequence that could matter could be, you know, this particular retailer charges from this IP. It could be anyone on a Friday night with this credit card. And so you kind of have to choose a broad swath of relevant sequences to capture kind of the last K that matters. So if you think about like a movie, right, like what are the scenes in a movie that you need to be watching to know if there’s something anomalous happening?

Swyx [00:07:57]: Yeah. And for listeners, I think you’ve talked about this in a number of places. The card testing detection numbers went from 59 to 97 percent.

Improving Fraud Detection and Identifying Suspicious Transactions

Emily [00:08:05]: Yeah. On large users. Which sounds pretty helpful. It was really helpful. But the other thing that was really helpful was like the speed at which we got it out. Right. So like we had a couple of the large AI companies came to us and they said, hey, this is like after card testing, they’re like, hey, radar is amazing for finding fraudulent disputes. And that’s what it’s that’s. That’s what it’s trained on. Right. Transactions that result in fraudulent disputes. But we have all these sus, like suspicious transactions that don’t result in fraudulent disputes, but we still want them flagged. We want them flagged because even though they don’t result in a fraudulent dispute, even though we get paid for them, like they’re bots, it’s not good traffic, like they’re messing up our numbers, all sorts of different reasons. We can talk about some of the fraud that AI companies are facing. And so we want you to send us a pipeline with all the sus transactions, even if they’re going to be revenue generative because we’re probably going to want to block them. And it was like literally days like, OK, like FM embeddings, clusters, you know, good textual alignments. You can start to label them and you’re like, this is the clusters, you know, that look sketchy because they are enumerating some component of the login flow. These are the these are the ones that look sketchy because they’re enumerating some components of the login flow. These are the ones that look sketchy for X, Y, Z, other reasons. And then the AI companies could literally say, OK, this batch we want to block this batch. We don’t. So it just allows you to move faster on identifying not just new fraud vectors, but like whole new types of suspicious transactions.

Alessio [00:09:35]: How has the scale changed with AI? So before, you know, I used to run some software website and we would have the same issue. People buy the software and then gets charged back. But it’s like 20 bucks. Like today, you could like, you know, use the credit card and sign up for the OpenAI API and spend $10,000. $15,000. Like what’s the shape of the fraud today?

Friendly Fraud in AI Companies and Its Economic Impact

Emily [00:09:55]: So friendly fraud is like not stolen card credentials, but something like nonpayment abuse, free trial abuse, refund abuse. So it’s me. There are my credentials, but I’m not actually creating a creative revenue for the business. This has happened for a while. And actually, if you if you ask business leaders like I think something like 47 percent payments, there’s like 47 percent of them will say that their biggest. Fraud challenge is friendly fraud. I would say this was like just much less of an issue for SAS for two reasons. One, like what were you stealing? You weren’t stealing computer inference or whatever. And two, more importantly, even if you were stealing some service, like the marginal cost of providing that good or service for Salesforce or whomever was like near zero. And so it didn’t totally crush your unit economics. Now we’re in the world where GPUs are expensive. Inference costs are high. And free trial abuse. Free trial abuse or refund abuse or general nonpayment abuse. Right. You you rack up these charges and you never pay is like existentially threatening for AI businesses. I was talking to a small AI founder the other day because we’re building sort of a suite of radar extensions that are explicitly targeted at this type of fraud. And everyone tells me it’s a huge issue. And so with every company I talk to, I try to dig in on for you. What exactly is the issue? And there’s the first guy who told me it’s not an issue. And I was like, oh, fascinating. What are you doing? He’s like, well, I. I completely shut down free trials and I dramatically throttle credits until you’ve proven ability to pay. And I was like, well, you don’t think fraud’s an issue, but it’s like totally like you’re choking your own revenue. Right. So anyway, we worked with it. We got free trials back on. And that’s that’s in flight. What’s interesting. This is definitely a problem for AI companies because of the marginal cost. But it’s not only a problem for AI companies. If you think about like advertisers. Right. If you’re like you’re like a social media platform. Right. Advertisers come in, you let them start advertising. They do post hoc billing. Right. So you rack up some spend and then you pay. And if you don’t pay, that actually is expensive. Not because you’ve sold on compute in this case, but because you’ve taken ad slots from businesses who would have paid. Fascinatingly, I don’t know if I should mention. I think I could say it. OK. So my friend got a Robin Hood credit card the other day. Yeah. And literally as part of getting the Robin Hood credit card, he was marketed that he could also get. Free trial cards and I was like, oh, tell me more. What are free trial cards? Free trial cards are basically like cards with your name on them that are good for 24 hours and then expire so that you can sign up for free trials without ever having to get charged. So in the hands of a well-meaning consumer, that sounds fine. In the hands of a fraudster, that’s like extremely disruptive to the AI economy. We just announced our free trial offering. We can catch the majority. We can catch the majority of free trial abuse at the source. We’re working on the analog for refund abuse. One of the places where refund abuse is really painful, you mentioned this in the context of large volumes, like some of these AI companies will have like enterprise grade plans where it’s like $600 or $1,000 or $10,000 a month for hundreds of thousands of credits in whatever units they’re providing. And those are the ones that are getting hit with refund abuse. So a lot of the free trial abuse is like the consumers, the little dollars, but it adds up. But a lot of the refund abuse. is like very, very large subscriptions. You use it in full and then you go and cancel. And we see the usage happening. So like, and we can verify that it’s the person. So there’s a lot we can do here. And I think we can burn it down, but it’s like clearly creating a lot of pain for the ecosystem today. And just that vignette of that founder who told me he’d solved fraud. I just, you know, I think that just speaks to like, it’s so painful. They will literally give up revenue to not have to deal with it.

Extending Stripe Radar for AI Business Models

Swyx [00:13:49]: I think you teased a little bit. About how you’re extending Radar to serve new AI business models. And I think Stripe in general, I think is interested in like enabling payments for, for these AI business models. But basically like what, what do people want and maybe what’s realistic versus what is not realistic. I don’t know if that’s a term.

Stripe as Economic Infrastructure for AI Startups

Emily [00:14:10]: For sure. So, you know, I think of Stripe as like the skeletal system for AI companies. So if you look at the Forbes AI 50. All of the. All of the Forbes AI 50 who monetize online, monetize through Stripe and what do they use us for? You know, most of these companies, I mean, you’ve seen it with like the, the cursor and lovable examples, right? They build these very scaled businesses with very lean teams. And so they want to go like all in kind of on Stripe to get many layers of the sort of economic infrastructure, financial infrastructure stack in one go without needing to hire humans to do it. So they use us for payments. These. They use us for payments. We were looking at the top hundred grossing AI companies on Stripe. And like the median was in 55 countries at the end of their first year and over a hundred countries at the end of their second year, which is like twice as global as the SAS wave from three years before. So they, they almost all adopt our optimized checkout suite, which comes with a hundred payment methods out of the box, very global reach. They almost all adopt radar and our fraud suite. And then one of the things that’s been really interesting is, you know, I think the, the market’s still trying to figure out what’s the intersection between supply and demand. And so there’s a lot of iteration across monetization models. Like, is it a fixed fee subscription? Is it pay as you go usage? Is it this credit burn down model? And there are revenue implications. There are also fraud implications, but equally important. There’s like unit economic implications. And I think one of our recent ahas was, you know, as the LLMs have gotten better, more and more AI companies are rappers and I don’t, I don’t say that in a, sorry, rappers are not an R and I don’t say it in a derogatory way. I say it in the same way, Arvind Srinivas once said to me, like, I am proud to have started as a rapper, product market fit and build an amazing product and move really quickly and not get slowed down in the research and other people could provide the underlying models. I could do that later if I wanted or not. But yeah. But because a lot of these AI businesses are rappers, right? Their services have an inherent LLM cost underlying them. We know that LLM model providers are ebbing and flowing. The underlying models are getting better or worse. The price of those models are getting better or worse over time. And so that actually leads to a lot of complexity in how you price your final service. When that final service is like so dependent on an upstream LLM. So one of the things we launched two weeks ago now, we call it token billing, but it’s basically you, it’s an API that lets you track and price to inference costs in real time. And what does that do? It’s like, well, if, if your service is built on underlying LLM and the model cost drops 80%, which we’ve all seen it happen, right? You don’t want to keep your price where it is because the competition is going to swoop in. But then conversely, and I think more threatening if the, if the cost of the underlying LLM three, Xs, which it also sometimes does, surprisingly, you could have unit economics that are literally underwater if you don’t, if you don’t adjust your price. So, um, you know, token billing is an example, but, but we’re seeing these AI companies, you know, iterate across usage-based billing, outcome-based billing is kind of an interesting one.

Token Billing and Real-time Inference Cost Tracking

Swyx [00:17:29]: Does Stripe get involved there because that’s not really within your normal wheelhouse.

Emily [00:17:34]: We do. So our, we have, so we have payments and then we have a billing suite and almost all the AI companies use our billing suite. Billing includes. It includes things like fixed fee subscriptions, but it also supports usage-based billing. So like metered billing, um, and you can define usage in all sorts of different units. And we have a number of customers, including Intercom who actually define it in terms of the outcome. So in this case, it’s like support cases, resolutions, exactly. And, you know, I, I think it’s really interesting. I’m an economist by training. I told you earlier in the elevator that I think physicists make the best, uh, scientists or MLEs, but I didn’t know that at the time. So I’m an economist. Um. And I think a lot about, okay, like what makes the market efficient or inefficient. Um, and one of the things that I worry about in AI is it’s incredibly hard to take a product to market when someone has to pay for it before they see the value. Um, and that’s especially true with AI because a lot of the buyers, especially enterprise buyers don’t understand how to evaluate the underlying technology. And so if you can get your foot in the door by saying not just, oh, you’ll only pay for what you use. I mean, pay for what you use. I mean, pay for what you use is kind of helpful because they’re not committing upfront to some huge contract, but they can come in with a fear like, well, what if my employees use it a lot and it’s not actually helping the business. And if you can come in with like an actual cost sort of pricing function that is clearly profit positive for them, um, it’s a lot easier to get your foot in the door, right? So, you know, that a human resolving a support ticket is X, I promise that I will charge you, you know, less than X, like it seems conditional on quality strictly better. Uh, for you to try out my service than not. So anyway, we see, we see a lot of outcome based billing. The other thing we see an interesting amount of from AI companies is stable coins. And this one’s, this one’s earlier, but their use cases are interesting. So like if you, if you go to V zero now and sign up for an account, you can actually pay, uh, in stable coins. We’re seeing this a lot for AI companies that want to have very global reach, but also for AI companies that have very high price points. So like shade form, the, the YC star. Up is a great example. Um, they accept stable coins. Stable coins are now actually like 20% of their volume and their use case for stable coins is basically like very global and very high cost. And so the global means ACH isn’t an option, right? ACH is usually what folks in the U S would go to for low costs. If you’re going to use something like, you know, international cards though, on like a very large basket costs, you’re talking about paying four and a half percentage points, literally. Just to international card costs. And so that’s just taking a bunch of your margin that you don’t, that you don’t want to give away. So now 20% of the volume comes through stable coins. We actually did an experiment with them and half of that is fully incremental, which is to say they would only have 90% of the revenue they had, had they not opened up stable coins. The other half is a shift from other payment methods to stables. And then on the cost side of the house, you know, the cost of stables for them is like 1.5 percentage points versus 4.5 percentage points. So that’s a couple extra percentage points. So stable coins is another thing that we’re seeing AI companies adopt pretty quickly. I like to say that nerds buy from nerds and so there’s a nice sort of network effect there, right? Like if people who use AI have stable coin wallets, when they go to the next day, I provide her, they have a stable coin wallet, right? It’s sort of self-reinforcing. We also see this with link, which is our consumer product. Like link just passed 200 million consumers. So it’s not a small network. But what I think is more interesting is in the case of AI, it’s a very, very dense network. So lovable accepts link 58% of lovable’s volume flows through link. So for every three people who are buying on lovable, two of them are buying with one click link checkout because they already have a link account. And I think that just like gives you a flavor of, of the density of the link network, but also the density of the AI network. Yeah.

Adoption of Outcome-Based Billing and Stablecoins

Swyx [00:21:37]: Is there a, are there classical measurements of network? Is there a network density that you keep an eye on, even though it’s obviously as an economist, like that’s the first thing I go to. Yeah.

Emily [00:21:46]: Um, I mean, the Herfindale index is less about network density in particular, and more about, as we look at all of the transactions that are flowing through Stripe, how concentrated are they on? I mean, you can look at it along a lot of dimensions. You can, and merchants, how concentrated are they on certain merchants versus spread across merchants? Yeah. How concentrated are they on certain industries versus spread across industries? How concentrated are they? How concentrated are they on certain geos versus a broad range of geos? And yeah, we definitely track that concentration. Now for us, some of that is actually the inverse of network density, which is we want diversification, like, you know, um, and we want to be exposed to many different industries and many different markets and have global reach because the current wave is AI and I am incredibly bullish on AI, but we really want to be growing the GDP of the internet broadly. And that’s not constrained to only the AI domain. Yeah.

Swyx [00:22:38]: Um, excellent. Should we, uh, move into the ACP? Uh, I don’t know how to transition it better than that. I agents do want to eventually do commerce between themselves. I guess that’s the transition and that, that, that, uh, is that the perfect intersection of financial infrastructure and AI. So maybe, uh, could you tell us the story of ACP, right? Like, I think, uh, this is one of the, the, the biggest launches of, I guess, like in the, in, in, in the second half of the year and, and like, I guess a really important strategic move between OpenAI and Stripe. Yeah.

Introduction to Agentic Commerce Protocol (ACP)

Emily [00:23:09]: So, you know, we talked a bunch about AI companies in general. One important slice of AI companies is AI commerce, agentic commerce. And, you know, I think just zooming back, like we’re all spending more and more time in some combination of broad consumer-based tools like ChatGPT and AI dev tools like Replit or Vercel or whatever. Right. Right. Right. Right.

Emily [00:23:43]: And I think, you know, we saw an early version of this in ChatGPT with Operator, but an important area we want them to take action is buying on our behalf. You know, sometimes it’s recommending products, but often it’s like literally getting it all the way over the wall. So, um, a couple of weeks ago, we announced our agentic commerce protocol, which is joint with OpenAI, and it’s basically just a shared standard for how businesses can talk. So if you think about it, like it used to be that a human was buying from a business, now there’s an agent that’s sitting in the middle and that fundamentally needs to change how the financial infrastructure works, like checkout needs to look different, fraud checks need to look different, payment flows need to look different, but also merchants are trying to figure out how they can efficiently expose their product catalog, their inventory, their brand, their pricing through a range of agents to have access to their products. So it’s kind of a brave new world. So the agentic commerce protocol is really about that shared language for agents to get from merchants what products they have available at what prices, how they want the brand to appear. And then we also built a shared payment token, which basically allows the agent to pass over the required payment credentials on behalf of the buyer, because the agent doesn’t want to bear the risk. The agent doesn’t actually want to be in the middle of the transaction. And the merchant wants to, you know, undertake the charge and actually have the direct relationship with the consumer at the end of the day for returns and more. And so the shared payment token was also an important component. And then fraud was another important component, right? Is this a good bot or a bad bot? There was a day not very long ago when the optimal thing to do as a business was to block all bots. Now, many bots are good bots. You do not want to cut off that demand. And so what we pass over as part of the shared payment token includes scores on the goodness of the transaction so that the merchant can make the right decision. One of the ways this manifested was an instant checkout in ChatGPT. Have you guys bought anything from this?

How ACP Enables Instant Checkout with ChatGPT

Swyx [00:25:55]: Not yet, honestly. I’ve tried. It just recommends things, but I always want to take over the last mile of checking it out myself. It’s hard for me to, like, hand over control.

Emily [00:26:05]: Okay, yeah. And I think they’re also still, like, iterating on their recommendations. To some extent, last night, my daughter was at a class, and so I took my son out to dinner, and he told me he has a school play, and he is supposed to dress as a Spanish shopkeeper. And so I tried to search for, like, kids’ Spanish shopkeeper outfit, and they recommended me a $1,300, like $1,300 bolero off Etsy.

Alessio [00:26:29]: The play is not that important.

Emily [00:26:31]: I love the child, but the play is not that important. But there is a lot of great stuff you can buy. And so in the... In the initial Instant Checkout Lodge with ChatGPT, you could buy from U.S.-based Etsy sellers. There’s over 1 million Shopify merchants coming soon, including some really big ones like Glossier and Viore. This week, Salesforce announced that they’re also in. And then, you know, my favorite is that, like, a week ago, two weeks ago, you could have asked, hey, are the largest retailers going to get on board with this or not? In the last couple of days, Walmart and Sam’s Club have just signed up to also make their inventory purchasable through ChatGPT and the Agentic Commerce Protocol, which, like, I don’t think that there is a bigger signal on a big retailer being up for it than Walmart. The world’s biggest one, yeah. Yeah, yeah, yeah. So that’s pretty exciting. And then, you know, one of the things that is important to us and to the broader ecosystem about the Agentic Commerce Protocol is, is it’s not about Stripe. So that shared payment token I talked about or the Agentic Commerce Protocol, like, that works no matter who your payments provider is. We can pass the shared payments token over to any other PSP. You don’t have to process on Stripe. It’s also not just about OpenAI. And so in the same way that, like, you and I are seeing, you know, new models come online all the time, we want to be able to move across models flexibly, there’s going to be sort of new agentic buying experiences coming online. And we want to make it easy for merchants and kind of, like, one shot to integrate with all of the agents as they come online. And that’s what the ACP really provides, because it’s a standard protocol versus needing to do custom integrations per agent. Did you guys see Karpathy’s tweet about the, he basically, like, recreated…

Swyx [00:28:27]: NanoChat? Mm-hmm. Okay. Yeah.

Emily [00:28:28]: So, like, if he can do that, 8,000 lines of code, less than $100, like, you might think that a lot of companies are going to roll their own really soon.

Swyx [00:28:36]: Using NanoChat? That would be interesting. I haven’t made that connection yet. Let’s see. Let’s see.

Emily [00:28:42]: But I think this basic premise that, like, it may be a winner-take-all, but it’s not yet clear who the winner is. And by the way, like, I hope for the efficiency of commerce that it isn’t a winner-take-all. Therefore, many merchants need to actually be having their products sold through many agents is kind of the premise of ACP. And we’re just delighted to see the early traction. And, you know, have just been flooded, honestly, with both merchants and AI platforms wanting to join. So, I think we’re on the right path.

Swyx [00:29:15]: Yeah. And this is your protocols, kind of. Yeah.

Alessio [00:29:18]: We did an episode with Crunch AI, which does web rewriting for agents. And they have him as a customer. They have scams. And I think every brand is, like, I mean, for brands, it’s very easy. It’s like, hey, I don’t really care where it comes from. Yes. If you buy my thing, we’re friends, you know. And I think, like, you take away. You take away the part which is, like, the most annoying to think about, you know, which is, like, the fraud. I do have a question on, like, the good bots, bad bots when it comes to, like, scarce releases, like tickets for events and things like that. I think that’s going to be interesting. Oh, please, Salt Ticket Master. Oh, my God. Exactly. It’s like, well, but now if anybody can just have an agent that just goes on the website to buy them, now it’s like, how do you do the queue? Because everybody gets there instantly, right?

Handling Good Bots vs Bad Bots in Scarce Inventory Scenarios

Emily [00:29:59]: I won’t say the company, but I had dinner the other night with the guy who’s the CEO of. You can basically. You can basically think of it as, like, StubHub for Country X. I won’t say what Country X is. And he was selling, I think it was, like, 3,000 Bad Bunny tickets. And he had 400,000. Oh, my God. People come to buy the Bad Bunny tickets, except almost all of those people were actually bots. And this is a great example of what we were talking about earlier, around, like, it’s not just about the fraudulent dispute. So the conversation I was having, he was like, you know, we have scalpers. Scalpers who have bots. They end up scalping the tickets later. They come and they buy. It doesn’t result in a chargeback. Like, they pay, but they’re not the people that we want paying. And so to our conversation earlier on suspicious transactions, like, there are lots of different types of fraud. And thinking of fraud as just things that result in a fraudulent dispute is actually overly narrow. And he wants to block, you know, all the scalpers, everyone who’s, like, you know, enumerating through email addresses in their signup and, and, and. The other thing he said to me, which was interesting, is he. He, for various reasons, and some of this is actually, like, the, the, the nuances of how his system is built. But I think some of it generalizes. He wants to have those fraud signals before they even get to the checkout page. And so how can we understand the customer independent of them entering their payments credentials? And there are a bunch of ways we can, and we can get better there. His particular reason why is he’s got, this is a little mundane. But once the ticket goes into the cart, it can’t be touched for, like, 10 or 15 minutes. And so even though, you know, it’s successfully blocked at the actual charge time, it’s, like, been held from, from those, those other good customers. So anyway, I, I think there’s this, there’s a lot of exciting work to be done that’s actually, like, increasingly possible. Not just because of the scale of the Stripe network, but also because of AI around understanding an expansive set of fraud vectors. And, you know, if, if you think about traditional. Terministic systems, you know, you’d write rules like block, don’t block. Now you can think about, okay, actually foundation model, text alignment, like human readable description of like why we’re worried about this charge. And then today, a human, tomorrow, an agent sitting on top of that and decisioning, like reasoning over, the model outputs. Um, I think that’s the world we’ll be in, in the next three to six months. Yeah.

Using Foundation Models for Advanced Fraud Detection

Swyx [00:32:28]: I think we need to. We have to be careful about rolling those kinds of things. Yeah. Because people get very upset and justifiably so, and they’re denied something that they, they, they should have by a bot that won’t explain itself. Yes. Right. There needs to be like an appeals process or like something like tier two human, like.

Emily [00:32:45]: For sure.

Swyx [00:32:46]: Can I speak to the manager, please? For sure.

Emily [00:32:48]: And yes, for sure. And well, humans make bad calls too. Sometimes they make bad calls at higher rates than LLMs because they can’t reason over as much information, but I agree. Definitely appeals process. But then also like. When we actually look at. Bad actors, it’s like a tiny, tiny share of bad actors accounts for a huge volume. Right. You’re just rooting those out. Of the bad outcomes. Yeah. And so what ends up happening is actually good actors have worse experiences, which could mean they don’t have access to free trials or they’re gated and how many credits they can use prepayments or they’re just charged a higher price because they’re covering for the cost of the bad guys. Right. And I, and I. And I actually think there’s an opportunity to like, you know, I’m from Montana, so sometimes I talk about sheep and goats, although I don’t actually know which is good and which is bad. Separate the sheep from the goats in a way that’s like really good for the good actors.

Swyx [00:33:44]: Why are sheep and goats bad? Like.

Emily [00:33:46]: No, only one’s bad and one’s good. But I don’t know which is. Why can’t they both be good? That was like an idiomatic expression everyone used growing up to separate the sheep from the goats. And I’m like, I don’t know. But they’re both good. They’re both cute. I think sheep are supposed to be cute, but I’ve always been impressed. Have you guys been to Yellowstone?

Swyx [00:33:58]: Yeah.

Emily [00:33:59]: You go into Yellowstone National Park, like the mammoth entrance, and there’s this like sheer giant, you know, wall of rock. And there’s these mountain goats. The goats just chilling. Exactly. They’re like scaling it at 90 degrees. Yeah.

Swyx [00:34:10]: Like mountains I get, but like dams, I don’t know why they love dams so much. It’s like, it looks so dangerous. And like there’s babies just walking on there.

Emily [00:34:17]: So dangerous. Yeah. It almost looks like AI generated the image, but it’s real.

Swyx [00:34:21]: It’s real. It’s real. And okay. I’m going to do like economist corner just because like, you know, you clearly still identify as an economist.

Economic Decision-Making in Ticketing and Market Efficiency

Emily [00:34:29]: I do identify as an economist. It’s very strange. Yeah.

Swyx [00:34:32]: Yeah. Yeah. Well, so like when you encounter those, like the StubHub for X, don’t you feel the temptation to recommend an auction? Like, and there’s so many auction mechanisms that can clear the market. This is clearly a market clearing problem. What’s the market solution here?

Emily [00:34:46]: I don’t know that I am usually tempted to recommend an auction. I am usually tempted to ask a lot of very probing questions about why they’ve designed the system the way they’ve designed it. Yeah. Yeah. Whether there’s a, whether there’s a more efficient path, but yeah, I, I feel that way about, um, most, most pricing matching discovery recommendations. Like most markets are just inefficient. And so I think there’s a lot of opportunity to make it better. Um, one of the reasons I joined Stripe and one of the things I have loved about being at Stripe for the last four years is when we see those opportunities to make the market more efficient. Um, we can, we can actually invest in doing them without optimizing them, you know, without monetizing them directly. So you can think of it like incentives are very aligned. Anything we do to help the businesses on Stripe grow helps us grow because, you know, they, they run their payments through us. Yeah. Um, and so we do this all the time. Like, here’s how to, you know, improve your checkout. And we just like update the checkout for them or like optimizing their payments acceptance or automating their retries. Um, so anyway, I think it’s just, it’s, it’s very nice to be at a company where you don’t have to worry about the go to market for something that helps the businesses that run on you. You just have to help the businesses that run on you do better. Um, and that in and of itself is, is a good outcome for your company and justifies the investment. Yeah.

Swyx [00:36:15]: They’re very incentivized. It’s like top line and bottom line sometimes. Yeah.

Emily [00:36:18]: And by the way, like this isn’t all causal, but, um, last year the companies on Stripe grew seven times faster than the SMEs.

Emily [00:36:31]: And, you know, again, like not all causal and there’s selection effects, but definitely some of it, some good, some good tailwinds. Yeah.

Stripe as a Growth Engine for Internet Businesses

Swyx [00:36:38]: Yeah. So, I mean, yeah. And I think the economist term I really like is deadweight lost and like basically like eliminating friction. It means improving surplus for both producer and consumer and Stripe benefits as a result. It’s just like, that’s nice. Everyone wins. Uh, it’s a, it’s a good, good, uh, fuzzy feeling. Coming back to the protocol. I think that it’s an interesting decision to actually release it as a protocol. Like you said, it’s going to be many to many. And like sometimes Stripe is not involved. You also mentioned like Stripe link and Stripe checkout, and those are Stripe products, right? Those are, those are not protocols. So I think like it’s a very interesting and pivotal decision to choose to release it as a protocol as, as opposed to not. I was wondering if there’s like any internal debate or is any internal color about like the decision behind choosing a protocol. Yeah.

Strategic Decision to Release ACP as a Protocol

Emily [00:37:21]: Um, you know, Stripe has moved fast for the entire four years. I think it is accelerating and I think it is accelerating because customers, users changes in what the market needs, both what businesses need and what buyers need, um, in the world of AI is accelerating. And so new products, new solutions like ACP, like token billing are literally being pulled out of us. And what we saw was a hole in the market, like consumers, and we can talk about developers too, but like consumers want to be buying through ACP. Agents, agents are ready to buy for them. Merchants are ready to let agents buy on behalf of consumers. And yet the market can’t figure out how to make it work. And that’s not about Stripe. That’s about growing the GDP of the internet. That’s about making sure commerce can flow. And, you know, so, so there was no debate. It’s like the ecosystem needs this. Like we will pair with open AI to get it over the wall. And, and by the way, like, as I said, we’re early days, you know, ACP is seeing a ton of traction, but. If it wasn’t, or if something different comes out six months from now, like all we want is a shared standard. We don’t need to have like our name on the shared standard. I think it’s absolutely, absolutely the right thing, the right thing to be doing. You know, I have had folks ask me like, is agentic commerce, just a straight substitute for the commerce that’s already happening on the internet. Yeah.

Swyx [00:38:47]: It’s just like fancy APIs. Exactly.

Emily [00:38:49]: And I think the answer is it’s not a straight substitute. I think it is actually like expanding the aperture of what. What commerce will get done. And the first person to put this bug in my head was Dwarkesh. And when he said it, it actually like took me a second, like, I didn’t believe it, but I think it’s right, which is if you look at the share of income that is spent on consumption as a function of how much income you have, you see that high income people spend a much lower share of their income, low income people spend a much higher share of their income. There are many reasons for that. But one reason is the biggest cost to very high income people consuming is not the dollar cost. It’s the time costs of consumption. And so I’m very interested in how agentic commerce can open the aperture for spending by high income people because it’s removing the most costly or binding constraint, which was their time. And we’re actually then truly pumping incremental, not substituted, but additive dollars into the economy. And obviously, like, you know, for. Yeah, well, it results in sometimes buying $1,300 costumes and I would rather spend an hour than buy a $1,300 costume.

Agentic Commerce Expanding Consumption Capacity

Swyx [00:40:08]: Well, you know, just work a few more years to stripe. You’ll get it. So so I think one like there’s some I think interesting where I love protocols, you know, as a developer tools person, I’ve been I’ve been involved in designing a few of them, debating a few of them. What are the forks in the road that, you know, like someone else was like discussing? Something really strongly, and we decided against it, or maybe it’s still an open question. I’ll give you one and then maybe you can volunteer another. So the I mentioned that both Solana and Circle have sponsored my conferences before, and they’re also trying to be that build a protocol for agents and both of them actually give agents a wallet, right, as opposed to a payment token. And I think like having an agent with their own bank account effectively is an interesting choice. You didn’t go for that. So like, is that a decision factor or is or is there a different one that you want to focus on?

Design Choices and Future Extensions for ACP and Agent Wallets

Emily [00:41:00]: Let me parse two things. When I think of the commerce protocol, that’s primarily around what’s the standardized way that businesses expose their products and their inventory and their prices and their brands and make those available to agents to expose to the consumers and or to buy on behalf of the consumers. That really comes down to like, how should a product catalog be expressed? How should prices be expressed? I think the current version is like the bare bones version, and it will continue to evolve. For example, like you could imagine like from a market clearing perspective that the merchant should also be as part of that articulating the cut that they’re willing to give to the agent, right? Like, like a little bit. Yeah.

Swyx [00:41:48]: In a classic, like if the human agent, I give them a budget, like what their negotiation target is and what their max spend could be. Yeah.

Emily [00:41:55]: Yeah, exactly. And so in this case, I’d be like, okay, well, you know, whatever, the Bolero that I didn’t buy is a terrible recommendation, but they have many good recommendations, but that was a terrible one. You know, this costs $1,300 on Etsy, but, you know, I’m willing to give X to any agent who facilitates the transaction, either on top of or underneath the $1,300. So anyway, I think there’s going to be an evolution of like the various parameters that should be included. But like the, the basic set was, what do you have to be able to deterministically expose to an agent so that they understand what’s available and what representation of the product and brand and, you know, sometimes it’s size and number and whatever, like has to be made available to the agent and or the, the, the human that’s initiating in the first place. Okay. Okay. So shared payment token is a little bit different, which is like, okay, how do you actually get the transaction done? Like, how does the money flow? And even at Stripe, like that has been evolving. So shared payment token is, is what we built and launched and have in the background of the instant checkout implementation with ChatGPT. But a year ago, Perplexity launched a travel search and booking agent. Did you guys see this? Yep. That is also powered by Stripe. And there, the payment flows are a little bit different. So we have an issuing product, which allows you to issue virtual cards. And what happens in that sort of flow is the agent gets issued a one-time use virtual card to spend on your behalf. And, you know, people get very, get very jumpy about that. But I like to remind them that like, when I order from DoorDash, my Phil’s coffee, right? DoorDash is issuing a one-time use virtual card to the, for $6, believe it or not, to spend on my behalf there. And so now you’re just inserting, you know, AI agent instead of human agent. And in the same way that my DoorDash driver never saw my card credentials and couldn’t spend, you know, more than $6 and had to spend it in a constrained time window near my house, same thing for the AI agent in the Perplexity travel search and booking agent. And we still have agents doing commerce through Stripe. Using the virtual card implementation and their pros and cons. So I don’t think that like, it’s going to be all virtual cards, going to be all shared payment tokens. It’s going to be all agent wallets. I think stable coins will be an interesting direction. I think wallets in general will be an interesting direction. I think stored, stored balances will be interesting, especially as we’re talking about kind of micro transactions, right? So we’re talking a lot about buying like goods, buying goods are usually priced high enough that it’s worth sort of like a car. Card transaction type approach. But if you’re talking about buying AI or buying some inference or buying content, you want to be able to make 5, 10, 25, 50 cent transactions. And those are hyper inefficient in the card world. So I think agent to agent payments are going to push us a little bit to the next frontier here. But ACP, again, is like distinct from how the shared payment token works or how the money flows. And I think that will, A, continue to evolve just because the market needs are evolving and the technology possibilities. Are evolving, but B will also like also doesn’t need to be standardized in the same way.

Agent-to-Agent Payments and Microtransaction Infrastructure

Swyx [00:45:28]: What about the receive side? I guess, can my agent make money for me?

... [Content truncated due to size limits]